SUMMARY

It’s essential to understand all the financial aspects that go into selling your home before putting it on the market. From closing costs to market conditions, understanding these elements can help you make informed decisions.

Your Financial Life

5 minute read time

It’s essential to understand all the financial aspects that go into selling your home before putting it on the market. From closing costs to market conditions, understanding these elements can help you make informed decisions.

Selling your home is a significant financial decision that involves a variety of considerations. Whether you're living in the city, settled in the suburbs or residing in a rural area, understanding the financial aspects can help you make the best choice for your situation. Here’s everything you need to know:

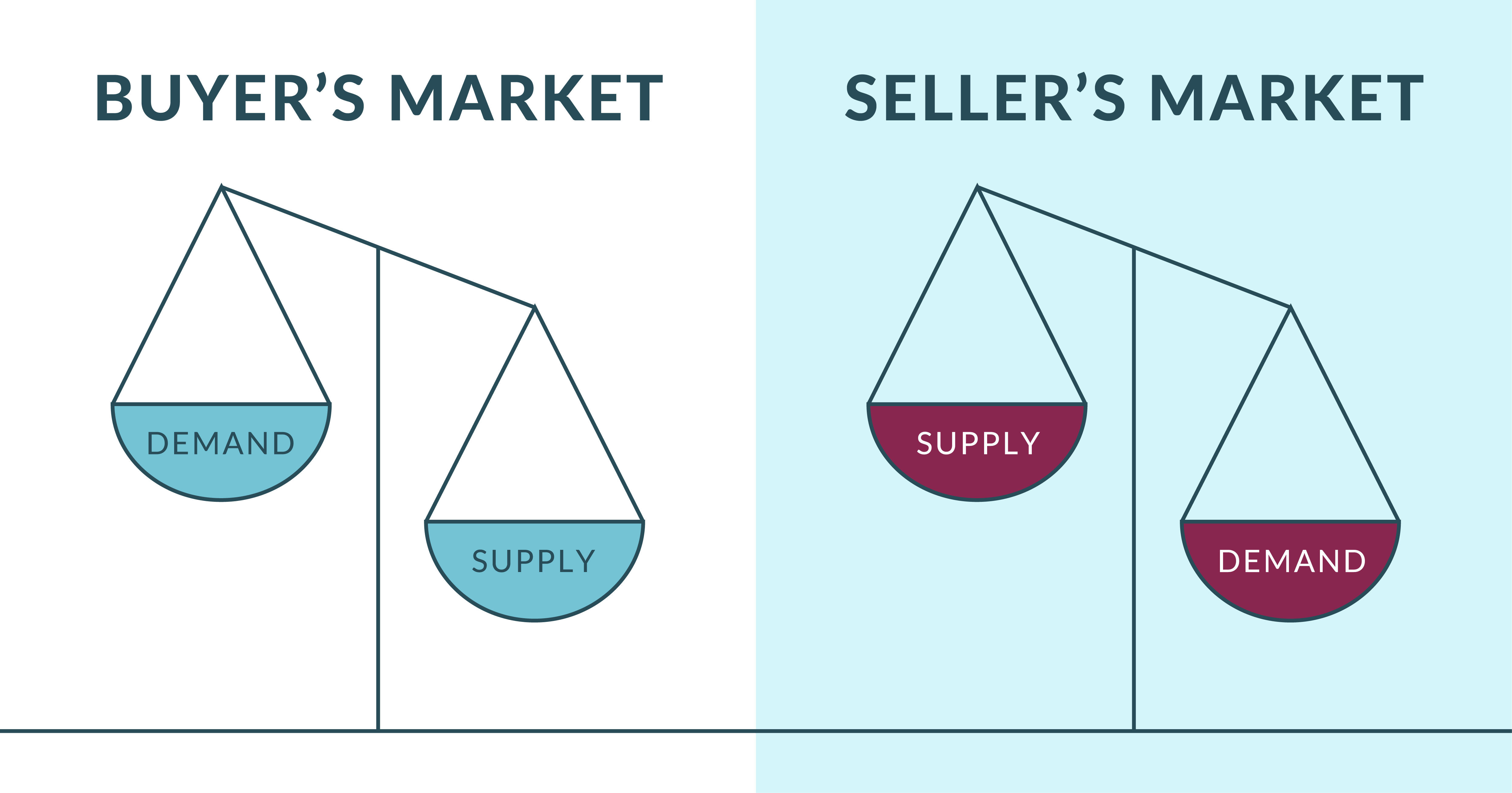

Short answer: It depends. The two variables you should consider are: 1) whether we’re in a buyer’s vs. seller’s market and 2) the season. In a seller's market, where demand exceeds supply, you can often get a higher price and sell more quickly. This is typically seen in spring and early summer when more buyers are actively searching. In a buyer's market, where supply exceeds demand, you might need to be more strategic about your timing and pricing to attract buyers. Some sellers may use the opposite strategy, listing their homes when there is less competition to make their property stand out. So, while May, June and August see increased demand, the optimal time ultimately depends on your specific circumstances and market conditions.

Deciding whether you're ready to sell your home involves a mix of personal and financial considerations. Here are some key factors to consider:

Before listing your home, consider your financial goals. What do you plan to do with the proceeds from the sale? Are you buying a new home, paying off debts or saving for the future? Consulting a mortgage professional can help you understand your budget and options and getting pre-approved for a mortgage can make the process smoother if you’re looking to buy a new home.

Determining your home's value is crucial. In metro areas like Milwaukee and Madison, where the market often favors sellers, you might receive higher offers. However, in more rural areas like Hayward, Spooner or Rice Lake, the market might be more balanced or even favor buyers. The easiest way to get an accurate home valuation is to work with a real estate agent, who can offer a realistic assessment based on their understanding of the local property market.

Before listing your home, you may need to make repairs or upgrades to enhance its value. While a seller's market might allow you to skip some of these expenses, investing in repairs and upgrades can increase your home's attractiveness to buyers and potentially lead to a higher sale price and avoid surprises that may result from a home inspection when you’re under contract.

Real estate agent commissions are another cost to consider. These fees can vary. A knowledgeable real estate agent can help you navigate the market and negotiate a better deal.

Closing costs are the various fees and expenses incurred when finalizing the sale of your home. They can include items like title insurance, attorney fees and transfer taxes. These costs can creep up, so it's important to budget for them.

Moving expenses are key to plan for, especially if you're relocating to a new city or state. Consider the cost of hiring movers, packing materials and any other expenses related to the move. Planning ahead can help you manage these costs more effectively.

If you plan to buy a new home, you'll need to consider the down payment and other associated costs. In a seller's market, you might be able to use the proceeds from your current home to make a down payment on a new property. However, if you need to buy a new home before selling your current one, you might face the challenge of making two mortgage payments.

Contact your mortgage loan officer to help you navigate options, such as bridge financing, amongst other options. It’s important to understand the financial implications and ensure that you not only qualify for these options but are also comfortable with the additional monthly expenses when making two mortgage payments.

Understanding your current mortgage balance and other debts is essential. You should consider how the proceeds from the sale will be used, such as paying off existing debts or serving as a down payment on your next home.

Selling your home can have tax implications. It's important to consult with a tax professional to understand how the sale will affect your tax liability. In some cases, you might be eligible for tax exemptions or deductions.

Market conditions play a crucial role in selling your home. Adjusting your listing price based on market feedback and appraisals can help ensure your home is priced competitively and attracts offers.

Selling your home involves a range of financial considerations, from the costs of selling to the market conditions and your financial goals. By understanding these factors and planning accordingly, you can make the process smoother and more financially beneficial. For personalized advice and guidance, connect with a mortgage lender today.